![]() Investors’ and advisors’ mantra is “focus on only one segment of the value chain”. Those are wise words… Unfortunately, when you’ve seen up close-up the root causes of the insurance sector’s failure to gain the consumer’s trust, you realise it couldn’t be solved by addressing a single value chain segment. The entire value chain and proposition needed redesign. Daunting prospect when financial backers shy away from such an ambitious approach.

Investors’ and advisors’ mantra is “focus on only one segment of the value chain”. Those are wise words… Unfortunately, when you’ve seen up close-up the root causes of the insurance sector’s failure to gain the consumer’s trust, you realise it couldn’t be solved by addressing a single value chain segment. The entire value chain and proposition needed redesign. Daunting prospect when financial backers shy away from such an ambitious approach.

I was a private equity investor in insurance and realised that all members of the value chain made extraordinary money (10%-40% EBITDA margin) and yet consumers trusted insurance less than banks, 5 years after the global financial crisis, blamed on the banks! Distrust by consumers is mainly driven by high price of insurance for poor claim experience – one of the rare service sectors where customers are treated like thieves when the service (they paid for) is delivered. The root causes of this are:

- fraud (20% of your premium goes towards it),

- lack of consumer centricity (cf 80 pages of policy document full of legal speak and exclusions),

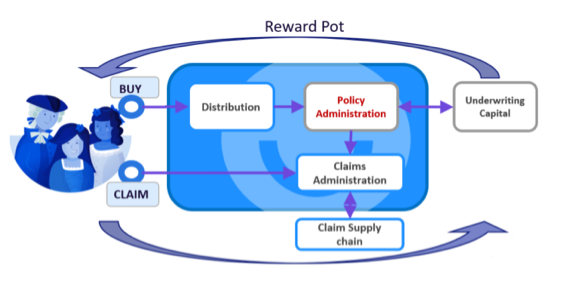

- misaligned incentives across the value chain:

![]()

Except for the rare ones who build a full stack insurer, insurtechs have followed conventional wisdom and focused on optimising a segment of this broken value chain. My approach was different, I realised we needed to fundamentally change insurance if we wanted to restore consumer trust in insurance. The insurance I wanted to create was a win-win one:

- Amazing if you need us: No small print, reliable payout and easy, fast claims (aspire to within 24hrs)

- Rewards if you don’t: get up to 80% money back, every year, when you and your friends don’t claim

To achieve the above, we needed to take a systemic approach to the insurance value chain. Being the UK, I knew that in 2014, raising a full stack insurer (no EIS/SEIS for early rounds) would not fly so I adopted a capital light model where I could:

- Redesign the insurance proposition to re-align incentives, and give money back to customers when they don’t claim

- Take full control of the value chain from purchase to claim without taking the balance sheet risk.

- Bring anti-fraud forward in the customer journey to ensure we can serve our claimants as customers with easy & (up to 10x) fast claim service.

This model requires outsourced underwriting capital that trusts SO-SURE to write and price policies. When you’re an experienced executive in the field it can take 2 years to find such a partner…if you’re new (like me), it is “show me the data” or the door slammed in your face! So, I developed Cycle Syndicate, a Peer to peer alternative to bicycle insurance, that I ran for 2 years to build the data. I was then able to secure the outsourced underwriting capital and build our entire stack from scratch to launch SO-SURE as a regulated insurance solution. We chose mobile phone insurance as our first line because we’re following the customer in their life and the first item of value owned by an adult is their phone.The journey was naturally not plain sailing. The underwriting capital partner we had chosen decided, after 6months of negotiations, to introduce at the last minute a clause that meant that they would have access to all our data. That was a complete no go as our IP would be leaked. Fortunately, I had a back-up solution. It took a few more months to get them over the line and we were to launch on Monday 27th June 2016. Following the Brexit vote on the 23rd, they decided to withdraw from the UK…and with that we lost our underwriting capital partner. We finally got to meet Salva Kindlustuse and Munich RE Digital Partners who understood how our model was disruptive and worth backing. So, we finally launched in record time (in the insurance world) by late September 2016 – a year after first engaging with underwriting capital partners.

This model requires outsourced underwriting capital that trusts SO-SURE to write and price policies. When you’re an experienced executive in the field it can take 2 years to find such a partner…if you’re new (like me), it is “show me the data” or the door slammed in your face! So, I developed Cycle Syndicate, a Peer to peer alternative to bicycle insurance, that I ran for 2 years to build the data. I was then able to secure the outsourced underwriting capital and build our entire stack from scratch to launch SO-SURE as a regulated insurance solution. We chose mobile phone insurance as our first line because we’re following the customer in their life and the first item of value owned by an adult is their phone.The journey was naturally not plain sailing. The underwriting capital partner we had chosen decided, after 6months of negotiations, to introduce at the last minute a clause that meant that they would have access to all our data. That was a complete no go as our IP would be leaked. Fortunately, I had a back-up solution. It took a few more months to get them over the line and we were to launch on Monday 27th June 2016. Following the Brexit vote on the 23rd, they decided to withdraw from the UK…and with that we lost our underwriting capital partner. We finally got to meet Salva Kindlustuse and Munich RE Digital Partners who understood how our model was disruptive and worth backing. So, we finally launched in record time (in the insurance world) by late September 2016 – a year after first engaging with underwriting capital partners.

We soon realised that in mobile phone insurance, hard fraud is 2x higher than in any other insurance lines! Incumbents have mature books to swallow the losses – we didn’t, so we had to address that promptly to ensure our outsourced balance sheet would support us over the long term (cf HeyGuevara closed in 2017). Then, as we started scaling, we realised our claim handlers could not meet our SLAs, thus destroying all our hard work to ensure customers had a great experience! That was our darkest hour. We switched the claim handlers out for more tech-enabled ones and developed our own claims platform which reduced claim processing time from days (sometimes weeks) to 5 hours. Finally, the insurance industry has 18-24months payback period on acquisition. To be backed by VCs, we needed to slash that down to <9months while maintaining 15% MoM growth rate. It wasn’t easy and it took time – for which we are grateful to our backers – but by delivering consistently superior insurance experience from purchase to claim and improving acquisition we are now scaling with outstanding unit economics.As our customers requested that we launch home contents for them – mostly renters – we did. Having demonstrated our model with mobile phones, it was easier to find underwriting capital partners and we launched in Q2 2021. We continue applying our principles and technology and have created a stunning home contents solution that addresses all the main pain points: reliability, right level of cover, payout quantum, claim process, and, cherry on the cake, up to 40% money back when you don’t claim. 🙂Our customer satisfaction and engagement metrics and unheard of in insurance, which suggests we are making forays on our mission to restore consumer trust in insurance. While we could be profitable at our present acquisition rate, we continue to raise capital to automate claims (this will be a first, globally), scale faster, launch new lines and build out our distribution partners with whom we embed our insurance into their services/products. We are so excited about what lies ahead. However, these opportunities and that level of customer engagement are the result of us rejecting conventional wisdom and having had the tenacity to go against the grain and take on the entire value chain…